The announcements made by the Minister are most disappointing. When world trade demand has shrunk by over 9%, a restatement of developmental efforts that have been going on, very marginal and routine things like promise to reduce transactions costs were the only elements. There is no strategy, no big push and certainly nothing to attempt to counter the fall in world demand: The credit initiatives, tax benefits, 15% enhancement of incentive rates in the advanced authorisation are hardly adequate to address the problem of sinking exports. Similarly, the announcement of trade agreements with the Asean, Korea and other countries are part of the developmental process of India’s trade relations and has nothing to do with addressing the near emergency situation. This was the time the government could have straightened the tax regime by moving completely to zero vatting of exports of all taxes both central and state, casting the same on a cash basis. It could have put in place a additional scheme to compensate exporters for the high energy prices (administered) in India on account of especially electricity. It could have forced the power ministry to re-work all cross subsidy charges as taxes which could then have been vattable. It could have announced a credit support at rates that match the credit supplied by China, Japan to India’s project and capital goods exports. It could also have announced major bilateral credit support to countries in Africa and elsewhere at zero rates for purchases made this year and the next, and built into the policy the commitment to match the credit terms of the governments of competing countries notably of China , Taiwan and Japan. Similarly it could have announced very long duration rupee credit loans at near zero interest to many countries not necessarily third world from whom there are purchases especially of raw materials by India. Defense purchase offsets being directed to purchases from India is another measures that could have been announced in coordination with the Ministry of Defense.

But perhaps the biggest option to really perk up India’s exports lie outside the government and with the ministry. What the minister did not mention is the huge trade deficit of more than 10% of GDP before the crisis, resulting from the adverse exchange rate and monetary approach of the Reserve Bank. This is in contrast to the huge surplus of the order of 6% of GDP on trade in China due to the more relevant interest rate targeting by the Chinese central bank. Indian exporters even when exports grew at over 17% in the four years before the crisis, had lower returns on exports as compared to domestic sales. China now has had the reverse situation ever since 1982. The RBI of course is bent on magnifying the “dutch disease” on Indian exports caused by the absolute advantage that we have in software and the large remittances that we receive owing to labour flight.

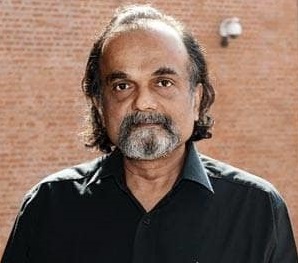

Sebastian Morris

Professor, Indian Institute of Management Ahmedabad

dt: 27th Aug 2009